Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Entering Workers' Compensation Settings

For this tutorial, we will enter your company's Workers' Compensation Board/Commission (WCB) rates. eNETEmployer requires these rates in order to calculate your company's WCB insurance premiums.

NOTE: Click on the images below to view them at full size

To Define Worker's Compensation (WCB) Settings for your Payroll:

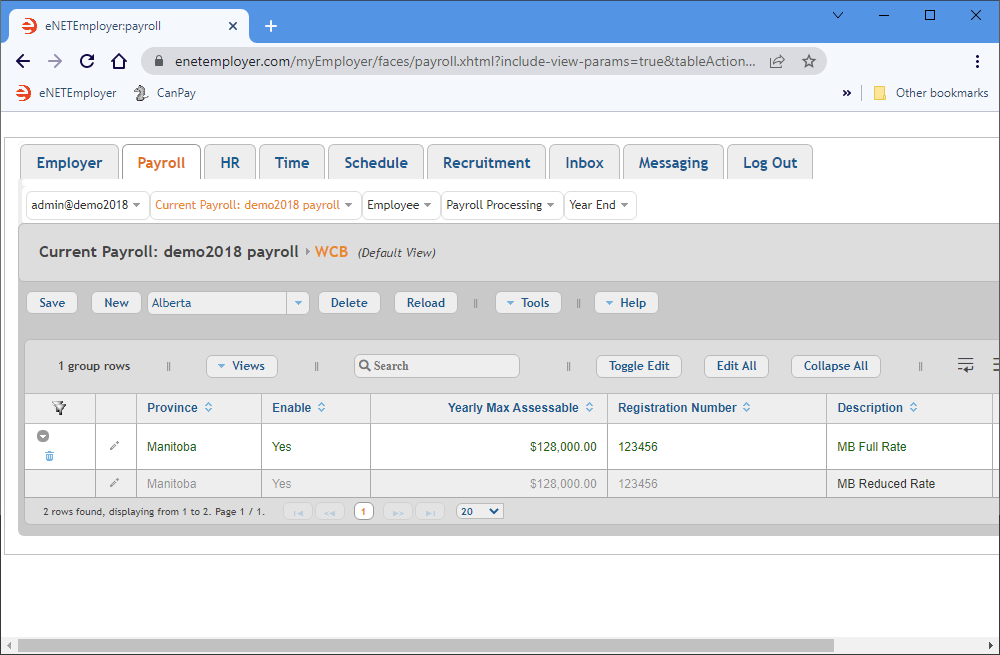

- From the Payroll tab, open the Current Payroll - WCB screen. This screen is used to define the Worker's Compensation details for your province (where applicable). Generally, if your business is incorporated, or if you have any employees, you must register with your provincial WCB so that you can remit WCB insurance premiums.

- Choose your province from the drop-down list beside the New button, and then click the button to insert a new WCB account row into the table.

- Edit the various cells as needed as they relate to your region's WCB settings (using the Online Help system if you need to look up a definition for the various cells).

- If your business has more than one account, use the New button to add another account type along with its pertinent information.

Example: In our example, we have added two rows for the WCB settings in Manitoba. The first row contains the regular rate and the second row contains a reduced rate for the corresponding job types.

Province Enable Yearly Max Assessable Description Rate/Hundred Manitoba Yes $128,000.00 Full Rate 1.50 Reduced Rate .68 - Once your data is complete, select the Save icon for each row (the check mark icon at the left side of the row). This accepts the changes and the Edit Mode icons are removed to indicate that the entire row has been saved. You can also choose the Save button from the Button Bar above the table.

This completes the tutorial on defining your company's WCB settings.

Note: If you are working through the payroll setup process in order, you will need to continue through the Payroll menu to finish entering the data that is required for your particular payroll.

See Also: