Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Working with an Employee's Year-to-Date Deductions and Benefits

For this tutorial, we will modify year-to-date (YTD) deduction and benefit information for our 5 sample employees. For our example, we will edit each employee's YTD values to reflect their payroll that has begun part-way through January (i.e. they have already been paid for one complete pay period).

NOTE: Click on the images below to view them at full size

To edit an employee's year-to-date deduction and benefit information:

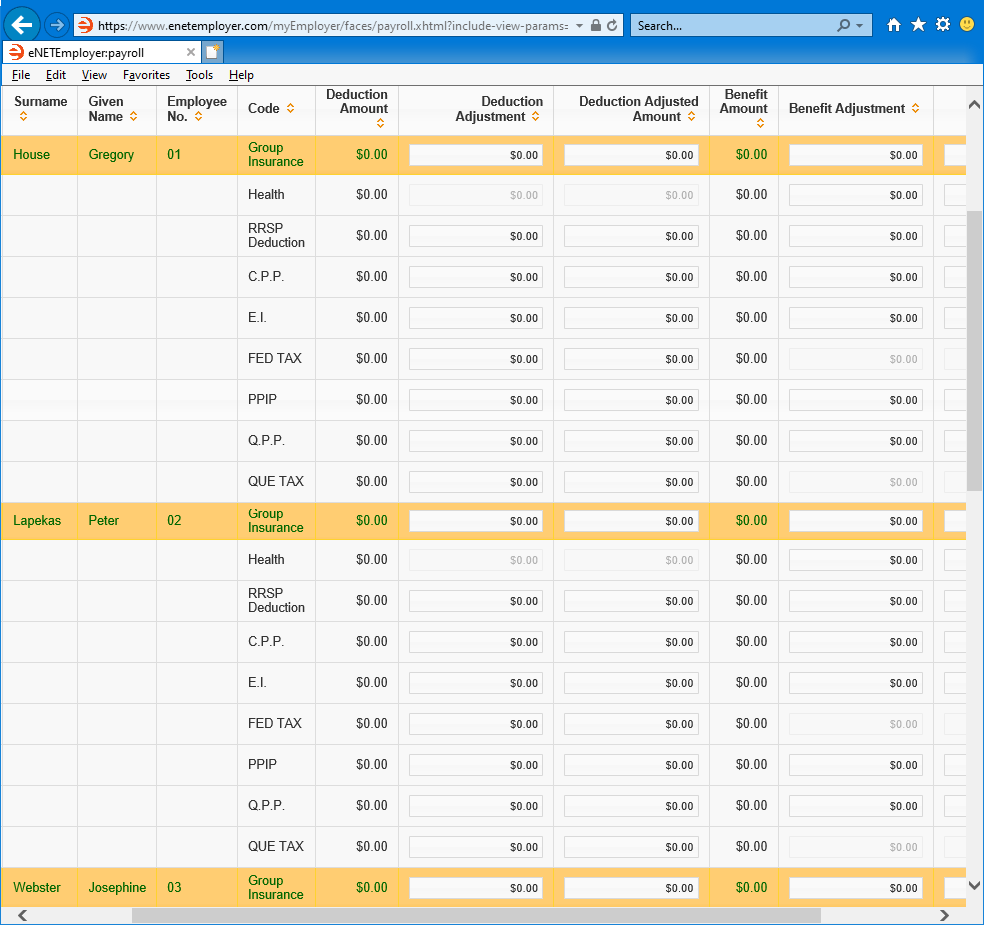

- From the Payroll tab, open the Employee - YTD Deduction & Benefit Items screen that is used to view, or to modify if necessary, year-to-date values for your employees. All payroll deductions and benefits accrue YTD values over the year and the resulting values are displayed in this screen.

- Right-click on one of the rows in the table, and then choose the Edit - Edit All command from the pop-up menu that appears. This activates Edit Mode for each of the rows so that you can modify the various cells. You can also choose the Edit All button from the Button Bar to perform the same action.

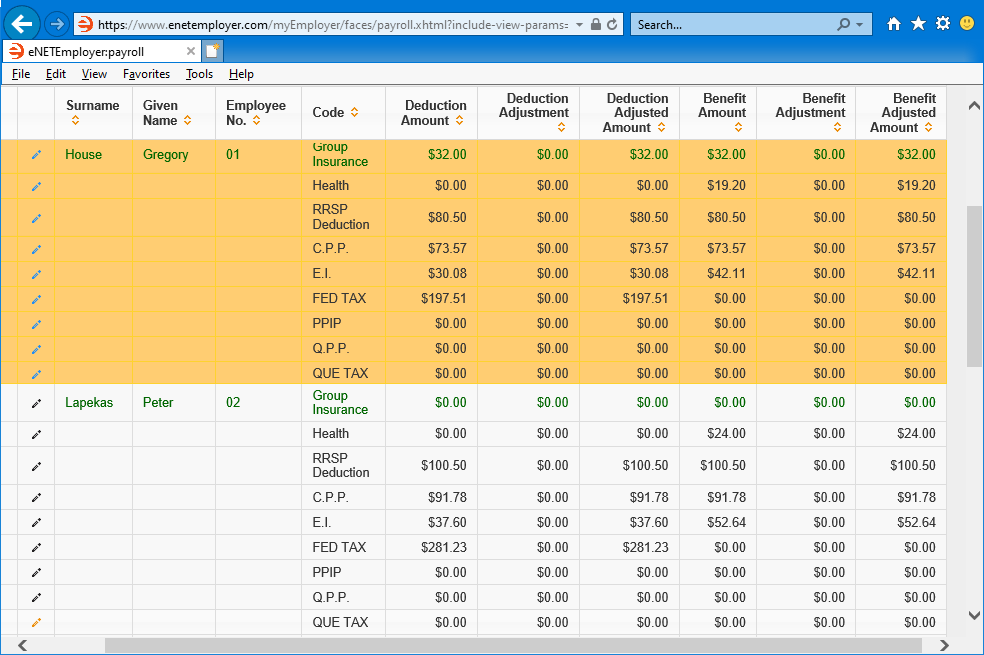

- Edit the YTD values as needed for your employees (press <F1> to use the Online Help system if you need to look up a definition for the various cells).

Example: Using the sample data in the table below (for our first sample employee only), we have entered the current YTD values into any rows for which the employee has deductions or benefits. In this example, we have edited the Benefit portion for provincial Health premiums while leaving the Deduction portion blank. Similarly, we have edited the Deduction Amount for the employee's Federal Tax while leaving the Benefit portion blank. - Once you have finished editing the YTD earning values, right-click on one of the rows in the table, and then choose the Edit - Accept All command from the pop-up menu that appears. This saves the changes for all rows. You can also choose the Accept All button from the Button Bar to perform the same action.

YTD Deduction & Benefit Items Help Screen...

Note: If you are working through the sample tutorials (or have completed Step 4B of the Quick Start Guide), then the five employees that you created earlier will appear in the table along with a number of blank cells that can be edited.

| Employee | Code | Deduction Adjustment | Deduction Adjusted Amount | Benefit Adjustment | Benefit Adjusted Amount |

|---|---|---|---|---|---|

| Gregory House | Group Insurance | $0.00 | $32.00 | $0.00 | $32.00 |

| Health | $0.00 | $0.00 | $0.00 | $19.20 | |

| RRSP Deduction | $0.00 | $80.50 | $0.00 | $80.50 | |

| C.P.P. | $0.00 | $73.57 | $0.00 | $73.57 | |

| EI | $0.00 | $30.08 | $0.00 | $42.11 | |

| FED TAX | $0.00 | $197.51 | $0.00 | $0.00 | |

| PPIP | $0.00 | $0.00 | $0.00 | $0.00 | |

| Q.P.P. | $0.00 | $0.00 | $0.00 | $0.00 | |

| QUE TAX | $0.00 | $0.00 | $0.00 | $0.00 |

This completes the tutorial on reviewing and editing an employee's year-to-date deduction and benefit amounts.

Note: If you are working through the payroll setup process in order, you will need to continue through the Employee menu to finish entering the data that is required for each new payroll employee.

See Also: