Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Creating Common Earning Types

This tutorial will show you how to create earning records and how eNETEmployer uses them to control the wages for each employee. Earnings can be set up as Hourly (to support varying work hours) or Salary (to support fixed wage amounts). Earnings can be assigned to pay a fixed amount, a calculated amount (based on a formula), or even an amount that is based on a multiple of another earning. Refer to the Earnings help page for more details on this topic.

For this tutorial, we will discuss how to create nine common earning types: Regular, Salary, Overtime, Double Time, Statutory Pay, Vacation, Commission, Bonus and Education.

NOTE: Click on the images below to view them at full size

To create an earning record:

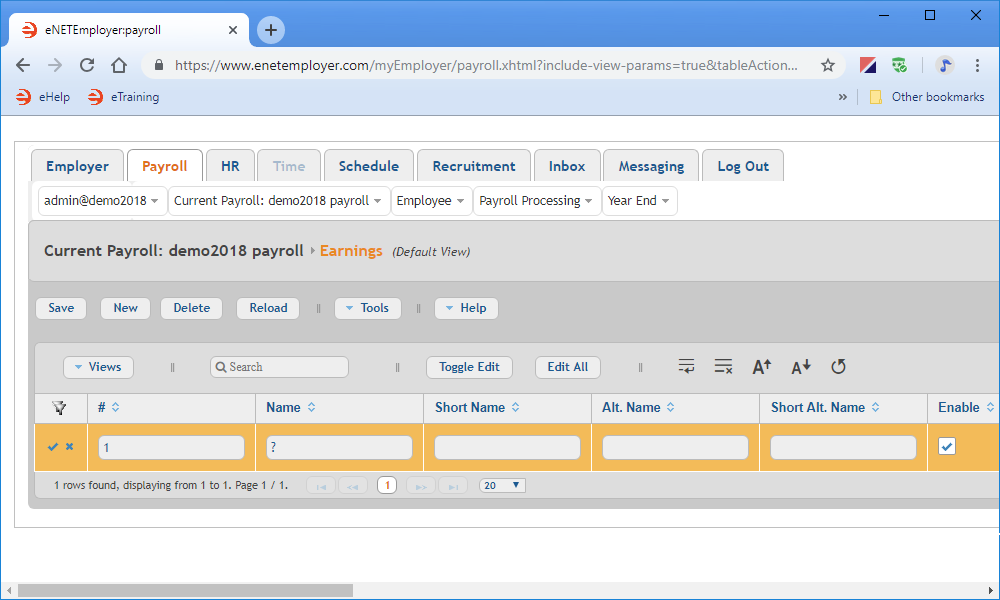

- From the Payroll tab, open the Current Payroll - Earnings screen where you can work with your payroll earning types (the records that control the wages or salary for each employee).

- Choose the New button to insert an earning row in the table. The row appears in Edit Mode with its cells ready for editing.

- Enter the data in each cell as it relates to your company earning (press <F1> to use the Online Help system if you need to look up a definition for the various cells). Variable rate earnings should be entered as the Hourly type, while fixed earnings should be entered as the Salary type.

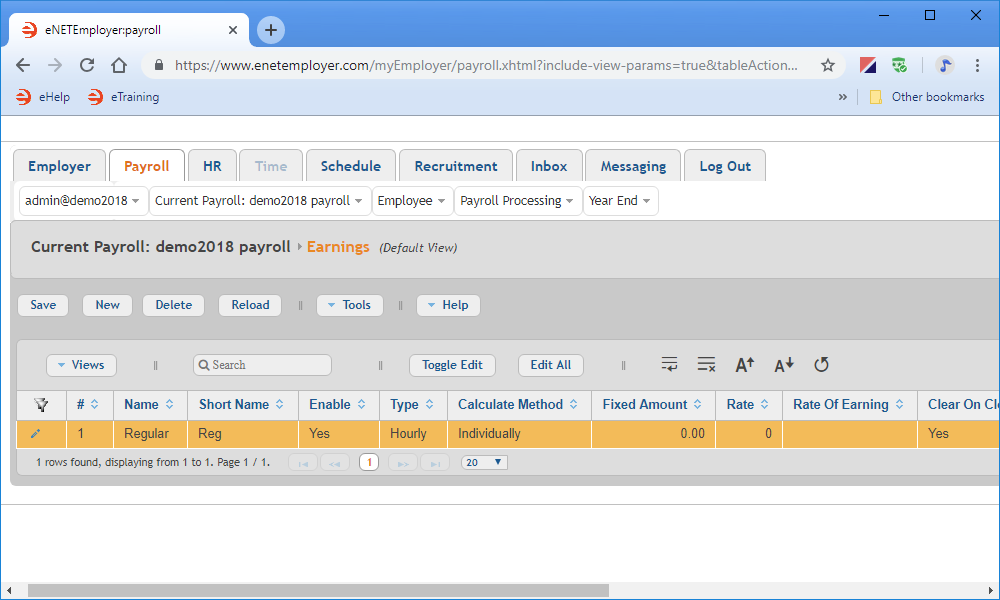

Example: Use the following settings to setup an hourly earning where employees have a set rate of pay with varying work hours each period: - Use the Save button (or the Pencil icon at the left side of each row) to save each row's information as you complete each new earning.

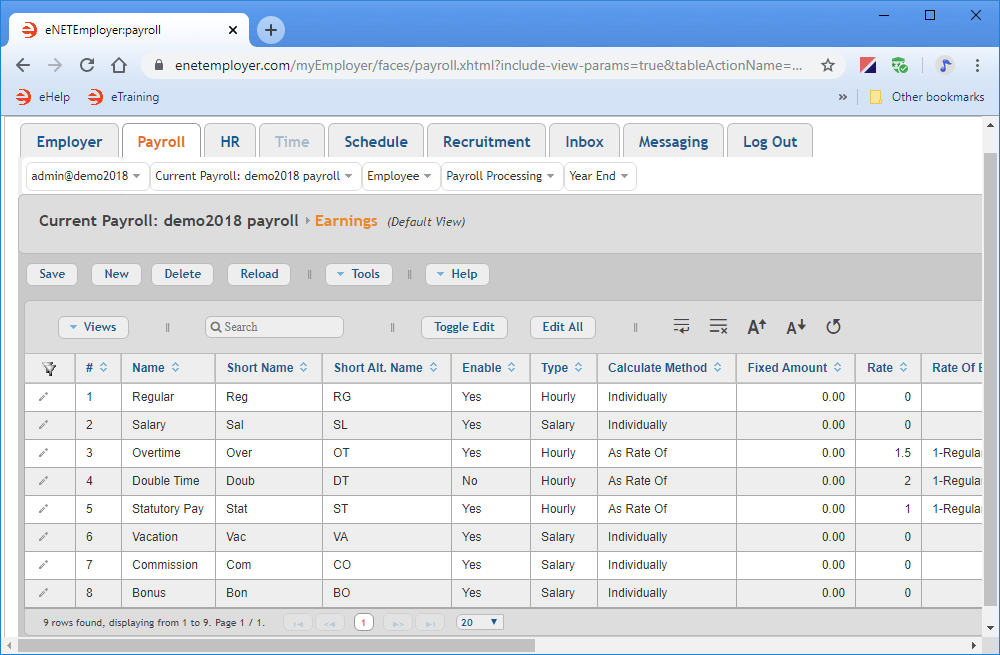

Example: In our example below, we have created 8 more common earning types that are found in a typical payroll. Consider the following as you create your earning types:

| # | Name | Short Name | Enable | Type | Calculate Method | Clear on Close | T4 Box | Taxable | Bonus Tax Calc |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Regular | Reg | Yes | Hourly | Individually | Yes | T4-14 Employee Income | Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP | No |

Notice that a number of details are applied for the new earning. For example, all new earnings are automatically assigned to Box 14 on the T4 - Employee Income. Similarly, all new earnings are also marked as being subject to tax in all categories (as shown in the Taxable cell). You can change any or all of these settings to suit your payroll scenario.

- Hourly Earning Types - Any earning that has the As Rate Of setting applied (under its Calculate Method column) must also have an associated earning defined under the Rate of Earning column. The earning must also have an assigned rate multiplier that will be based on the associated earning. For example, the rate for Earning #3 (Overtime) is set to 1.5 x (times) the value of Earning #1 (Regular). Therefore, if an employee earns $20 per hour for the Regular earning, any Overtime earnings would be paid at $30 per hour (i.e. 1.5 x the Regular rate).

- Salary Earning Types- All salary earning types (e.g. that do not change each pay period) should be entered as the Salary type in this screen.

- Other "Fixed" Earning types - Fixed earning types such as Commission and Bonus (as well as any other earning types that are based on a Function), should be entered as the Salary type in this screen. Note: Although our sample Vacation earning is tied to both Hourly and Salary related employees, it is classified as "Salary" in this screen because its payout is based on the result of a calculated function.

# Name Short Name Enable Type Calculate Method Fixed Amount Rate Rate of Earning Clear on Close T4 Box Taxable Bonus Tax Calc 2 Salary Sal Yes Salary Individually 0.00 0 - No T4-14 Employee Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No 3 Overtime Over Yes Hourly As Rate Of 0.00 1.5 1-Regular Yes T4-14 Employee Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No 4 Double Time Doub No Salary As Rate Of 0.00 2 1-Regular Yes T4-14 Employee Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No 5 Statutory Pay Stat Yes Hourly As Rate Of 0.00 1 1-Regular Yes T4-14 Employee Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No 6 Vacation Vac Yes Salary Individually 0.00 0 - Yes T4-14 Employee Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No 7 Commission Com No Salary Individually 0.00 0 - Yes T4-42 Employment Commissions Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No 8 Bonus Bon Yes Salary Individually 0.00 0 - Yes T4-14 Employee Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP Yes 9 Education Edu Yes Salary By Fixed Amount 25.00 0 - No T4A-28 Other Income Tax, QTax, CPP/QPP, EI, EI Hours, WCB, PPIP No This completes the tutorial on entering your company's earning information.

Note: If you are working through the payroll setup process in order, you will need to continue through the Current Payroll menu to finish entering the data that is required for your particular payroll.

See Also:

- Earnings overview

- Creating common earning types

- Working with advance earnings

- Adjusting pay rates in the middle of a pay period

- Paying an employee bonus using an Additional pay type

- Payroll earnings help topic

- Employee earnings help topic

- Assigning employee earnings manually

- Assigning employee earnings using a template