Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Working with Reports

eNETEmployer provides a series of pre-defined reports that are common to most payroll scenarios. Use the following tutorial to learn how to access the Reports screen, to create a basic report, and to apply custom report settings.

This tutorial has two parts:

NOTE: Click on the images below to view them at full size

To Create a Basic Report:

The following instructions can be used with any program report - This tutorial will use the Payroll Register for the lesson - you may choose any report type as you work through the instructions. |

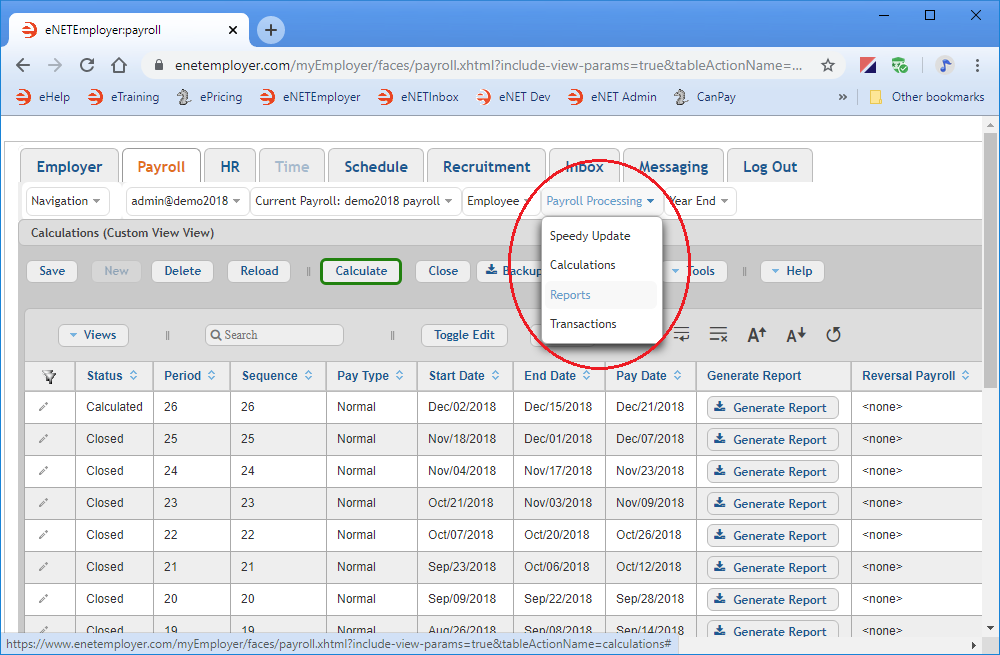

- From the Payroll module, select the Payroll Processing menu to view the available options.

- Choose the Reports option from the menu. This opens the Reports screen where you can work with all aspects of program reporting including viewing, printing, and exporting.

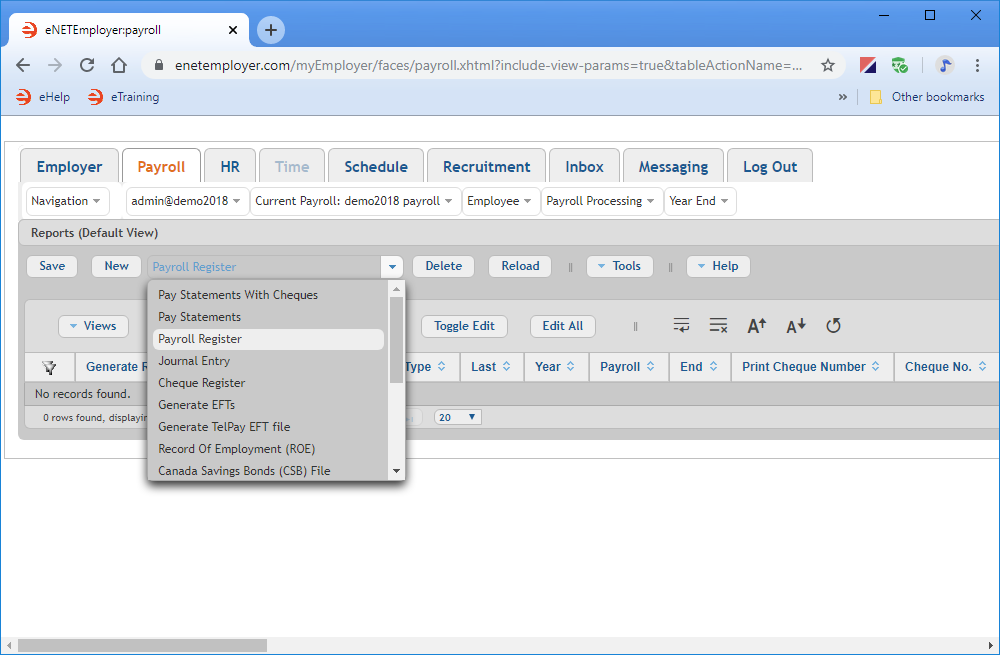

- To view the pre-defined reports that are available with the program, choose the downward arrow that appears to the right of the New button. This displays a menu with a number of common report types.

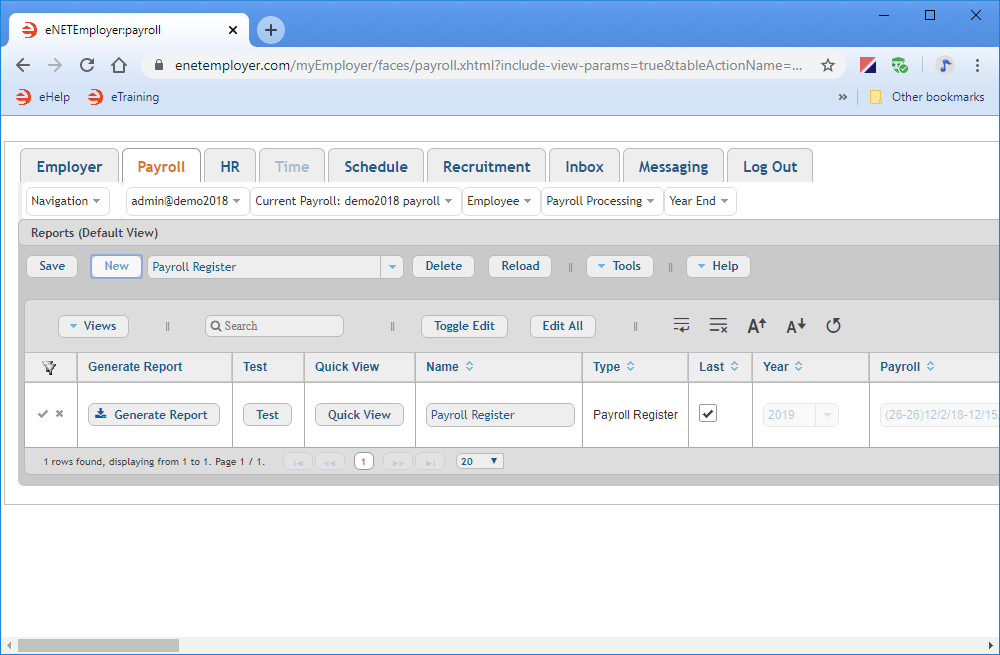

- For this lesson, we will select the Payroll Register option and then choose the New button to insert a blank report row into the table (you can choose another report type if you wish). The report row appears in Edit Mode so that you can change the default settings if you prefer.

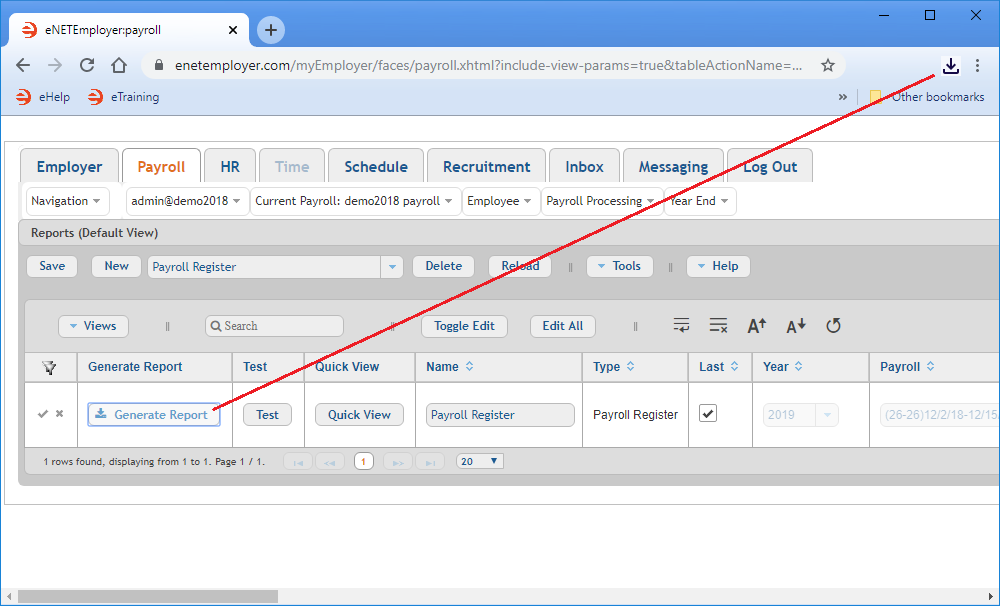

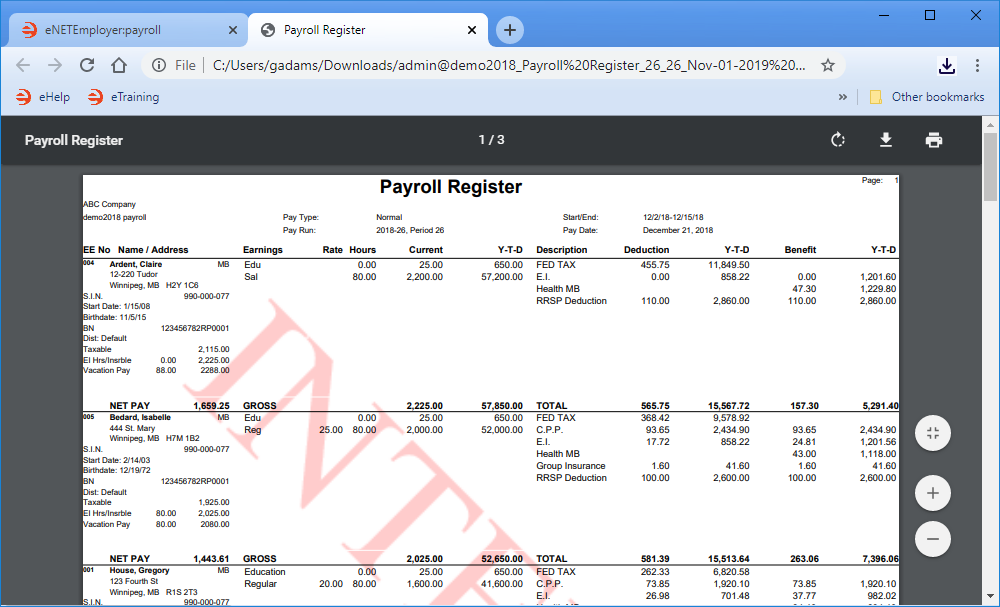

- With the default settings in place, choose the Generate Report button to create an interim Pay Register report as a .PDF document. Depending on your browser settings, the resulting document will either be stored in your Downloads folder or you may be presented with a window that will prompt you where to save the file. In most browsers, the document can be viewed via a link that appears at the top-right of your browser.

- Click the Download link to access the file, or navigate to your Downloads folder and open the document using your preferred PDF viewer. If you have not yet closed (finalized) your payroll, the word "Interim" will appear as a watermark in the background (as shown in our example below). This watermark will be removed once you close the payroll and regenerate the report.

- Scroll through the Payroll Register and you will see each employee's pay, deductions, and other relevant information. Once you reach the end of the employee list, the overall employee totals are shown.

- Scroll down further to the last page in the report and you will see the business accounts that are being used along with the Federal Tax, CPP, EI, and remittance amounts.

- When you have finished reviewing your payroll results, close the report and return to eNETEmployer.

Now that you know how to create a basic report with the default settings, let's learn how to modify the settings to customize our report.

If you have never created a report, the screen will not contain any report rows (as shown in Fig. 02 below).

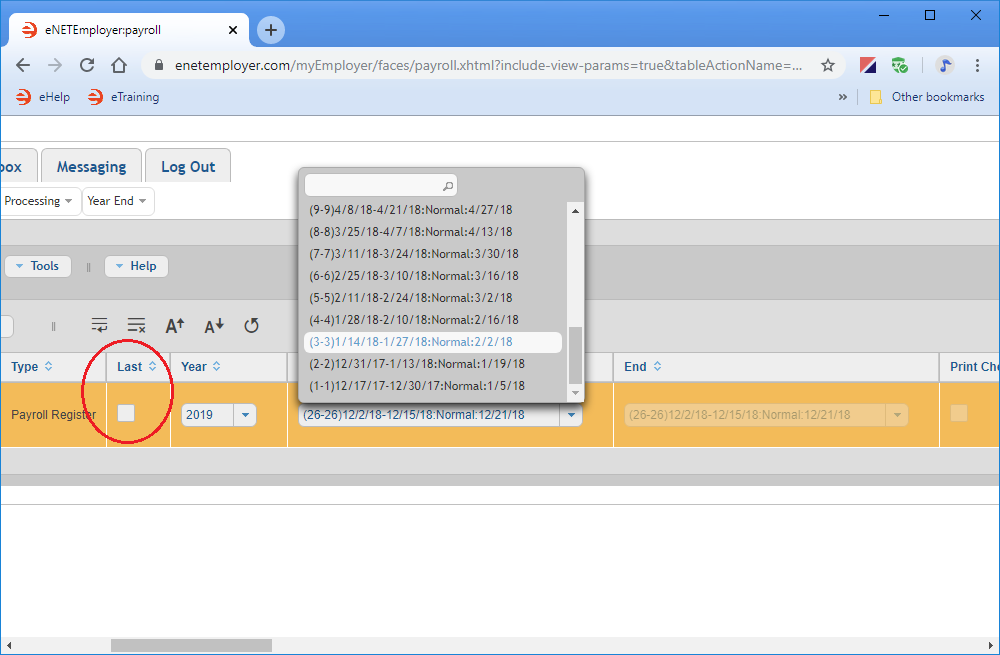

The default settings will vary based on your chosen report type. In the case of the Payroll Register, the report will be created based on the last calculated pay cycle. This is indicated by the check mark that appears in the Last checkbox.

To Change the Default Report Settings:

- Scroll over to the Last cell and click inside it to remove the check from the box. This action enables the Payroll cell so that you can choose a different pay cycle on which to base the report.

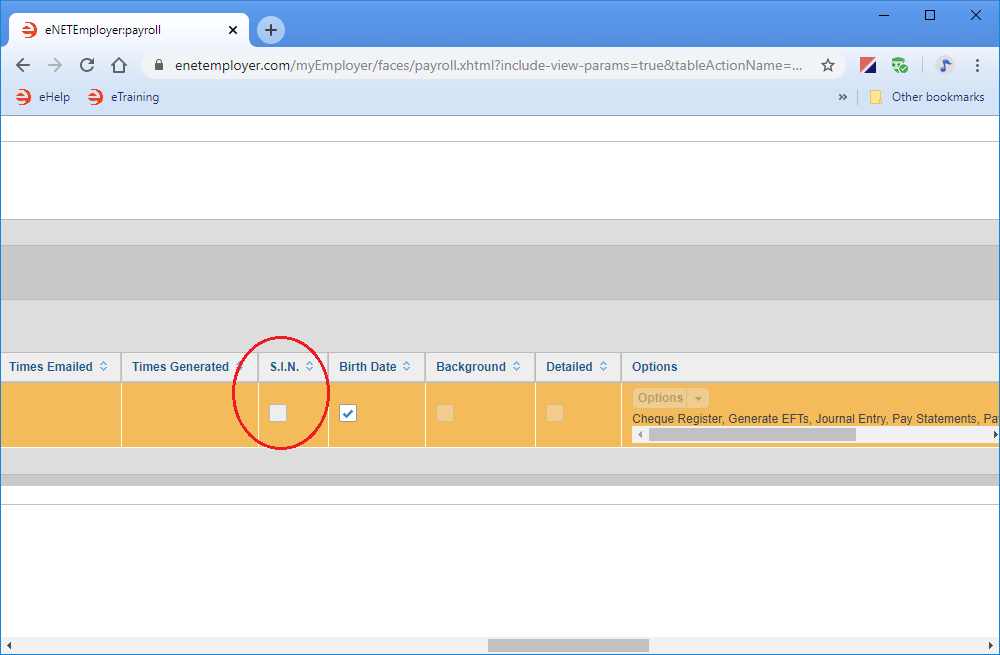

- Scroll further to the right until you see the SIN cell, and then click inside it to remove the check from the box. This action will exclude employee SIN numbers from the payroll register report the next time that you generate it.

- Once you have completed your custom settings, choose the Save icon (the Check Mark icon at the left side of the row) to accept your changes. This action saves the changes for the row and takes you out of Edit Mode. These custom report changes will now be in place the next time that you create the report.

This completes the tutorial on how to create a basic report. We also discussed how to apply custom settings that can be used in the report at a later time.

See Also

- Reports Overview

- Payroll Reports