Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Payroll Register Report

This report displays a complete summary of the payroll activity and wage amounts for each employee, for a specific pay period. Basic information is included such as the number of hours that each employee has worked, their gross pay, net pay, deductions, and the pay period dates.

Detailed information is also included such as each employee's Start Date and Birth Dates, Distribution (Department), Taxable earnings, EI Insurable Hours, and more. The report is useful to verify the accuracy of the current payroll calculations, and to provide a historical record for a given pay period.

| View step-by-step tutorial |

Section 1: Payroll Details

The top rows of the report displays the Payroll Name, Company Name, and the Sub Group (if you are using the Sort feature) as defined in the various setup screens when the payroll was created. Further details for the current pay period include:

- The period's Pay Type.

- The pay run's Year, Period and Sequence number.

- The pay run's Start Date and End Date.

- The Pay Date for the run.

Section 2: Employee Details

This section of the report displays the details for each of your active employees. The employees are ordered by their Surname by default (this setting can be changed in the Payroll Processing - Reports screen's Order cell).

- The first two columns show the Employee Number (EE) along with their Name and Address.

- The section underneath the first column shows further employee details:

- The employee's SIN (if display is activated in the Payroll Processing - Reports screen).

- The employee's Start Date.

- The employee's Birth Date (if display is activated in the Payroll Processing - Reports screen).

- The CRA Business Account number to which the employee is associated.

- The employee's Distribution. If none is assigned, it will show the Default.

- The employee's Taxable income total for the period.

- The employees Insurable EI Hours for both the current period and the YTD amounts.

- The last rows in this column show any accumulators that are assigned to the employee along with their respective amounts. Note: Most payrolls will typically have at least one "Vacation Pay" accumulator. The first column shows any accrued accumulator amounts for the current period, and the second column shows the accumulator's balance (see note below).

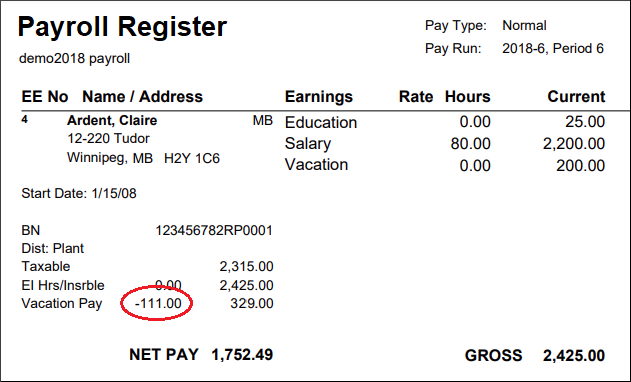

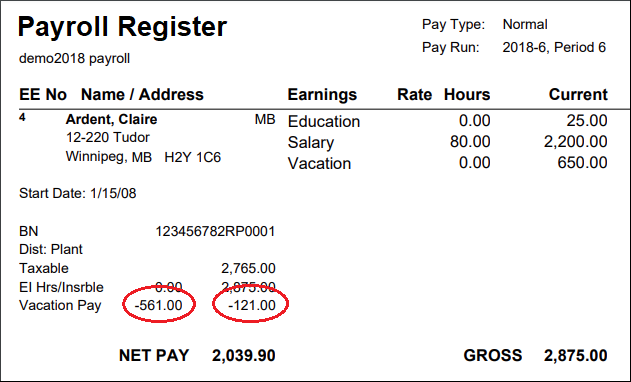

Negative Accumulator Amounts - Sometimes you may see a negative amount in either of the columns for an accumulator on the left side of the Pay Register report. There are several reasons this can occur:

- A change in accumulator balance: Any time an accumulator pays out funds, the column on the left will show the difference between the original accumulator balance and the debited amount.

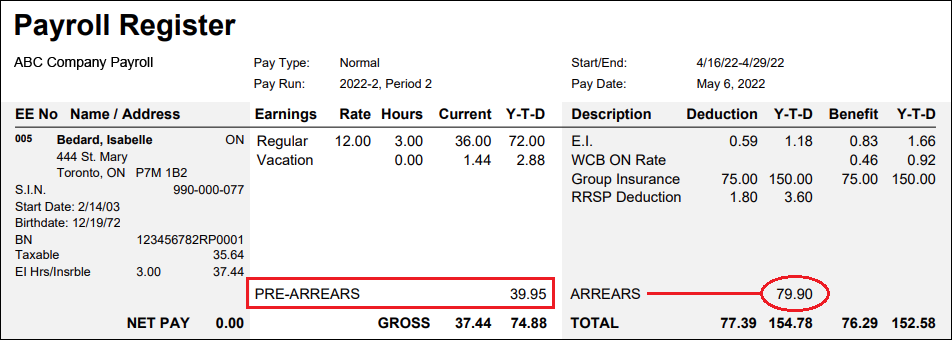

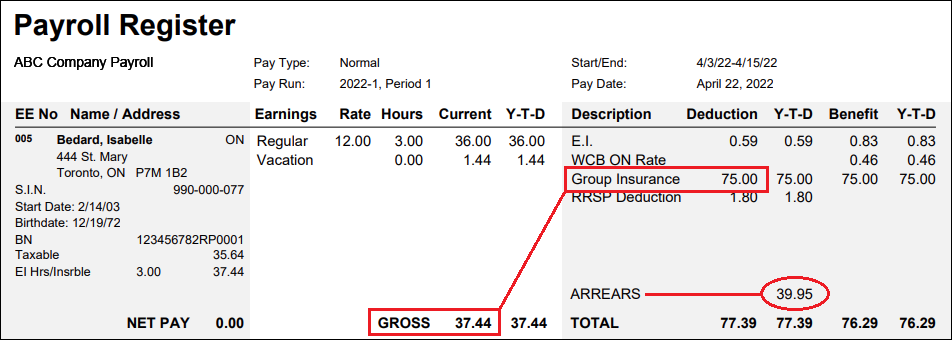

Example: In the image below, the value in the first column represents the change in accumulator balance for the current pay. Claire received $200.00 in vacation pay which resulted in a $111.00 being drawn from her original accumulator balance. - Paying out more than the accumulator balance - If the employee requests vacation pay that is more than their current accumulator balance, the column on the right will show the amount that was "overdrawn" from the accumulator balance. This is a common occurrence when a company allows an employee to take vacation with pay even though they have not yet built up enough funds in their vacation accumulator.

Example: In the image below (as with the earlier example), the value in the first column represents the change in accumulator balance for the current pay. The second column shows that Claire's $650.00 vacation payout puts her -$121.00 in arrears for the accumulator. Note: As the employee continues to accrue vacation, this value will eventually become positive.

- A change in accumulator balance: Any time an accumulator pays out funds, the column on the left will show the difference between the original accumulator balance and the debited amount.

- The middle 5 columns shows each employee's wages, including the type of income that was earned, along with the current period and YTD totals. Note: The details for the items listed below are defined in the Employee - Earning Items screen.

- Earnings - This column shows the employee's assigned earnings for the period.

- Rate - The assigned Rate of pay for each earning.

- Hours - The Hours that have been worked for the period.

- For Hourly earning types, these hours are entered in either the Employee - Earning Items, or Payroll Processing - Speedy Update screens.

- For Salary types, these hours are entered in the Employee - Earning Items screen, and are typically for EI purposes only. That is, the hours will not affect the rate of pay if the salary amount is fixed (i.e. the earning is set to not "Clear on Close").

- Current - The calculated wage amounts for the current pay period.

- YTD - The year-to-date (cumulative) wage amounts for each earning type. Note: If you used a Temporary earning for the period, its YTD total will be included in the row for the recurring earning of its type.

- The last five columns show the employee's Deduction and Benefit amounts, including the current period and YTD totals. Note: The details for these items listed below are defined in the Employee - Deduction and Benefit Items screen.

- Description - This column shows the name of each item. There are three categories of items that can appear:

- Statutory Deductions - The default deductions that are automatically applied to most employees, unless they are exempt: CPP/QPP, EI, and FED Tax (which is Federal and Provincial combined).

- WCB - The worker's compensation item, if you have created a WCB entry in the Current Payroll - WCB screen.

- Health - The provincial health item, if you have created a Health entry in the Current Payroll - Prov. Health screen.

- Custom Deductions/Benefits - Any custom deductions and/or benefits that you have assigned to an employee via the Employee - Deduction and Benefit Items screen.

- Deduction - The amount that will be deducted from the employee's pay for the current pay period. The Y-T-D column immediately to the right shows the year-to-date (cumulative) amounts for each deduction. Note: If you used a Temporary deduction for the period, its YTD total will be included in the row for the recurring deduction of its type.

- Benefit - The amount that will be paid by the employer on the employee's behalf for the current pay period. The Y-T-D column immediately to the right shows the year-to-date (cumulative) amounts for each benefit. Note: If you used a Temporary benefit for the period, its YTD total will be included in the row for the recurring deduction of its type.

- WCB - Amounts that appear under the Benefit column for WCB represent Worker's Compensation premium amounts that will be paid by the employer on the employee's behalf.

- Prov. Health - Amounts that appear under the Benefit column for this row represent Provincial Health premium amounts that will be paid by the employer on the employee's behalf.

- Description - This column shows the name of each item. There are three categories of items that can appear:

- The bold-font row that appears underneath each of the above columns shows the employee's Net Pay and Gross pay amounts for the period. Each employee's YTD totals are also shown for their various payroll items.

Section 3: Period Totals

This section of the report displays the current period totals for a variety of payroll items.

- The Final Totals column shows the following items:

- The number of Active Employees in the current payroll.

- The number of employees who have been Paid in the current period.

- The total Net Pay amount for all of the employees in the current period.

- The last rows in this column shows, respectively, the current period and YTD totals for your payroll accumulators.

- The middle 4 columns show the totals for all employee Earnings, Hours that have been worked for the period, the Current period pay amounts, and the YTD totals for the payroll.

- The last four columns show the totals for all employee Deductions, and Benefits, along with the respective YTD's.

- The bold-font row that appears underneath each of the above columns shows the totals for all employees' Net Pay and Gross pay amounts along with the YTD totals for all payroll items.

Section 4: CRA Remittance Information

This section of the report displays the information needed to make your remittances to the Canada Revenue Agency (CRA).

- The top two rows display the Payroll Name and Company Name, followed by the Pay Type, Year, Period, Sequence number, Start Date, End Date, and Pay Date.

- The Rev. Canada Remittance column displays the business account type (Full Rate, Reduced Rate or Other, as defined in the Current Payroll - Business Accounts screen when the payroll was created). The total number of Employees included in the remittance total is also listed.

- The Business Number column displays the payroll's associated BN number followed by the Gross-Taxable amount for the period.

- The Description column displays the current period totals for Federal Tax, CPP, and EI.

- The Total Can amount represents the amount that must be remitted to the CRA for the current period.

Reduced Rate Section - If your payroll uses a reduced rate, this section will show the "reduced rate" account totals for the same items as described above.

Interim Watermark - If you generate this report for a payroll that is not yet closed, the word "Interim" appears as a watermark in the background. This watermark will be removed once the payroll is closed.

See Also

- Reports Overview

- Payroll Reports