Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

CPP/EI Mismatches

If you create your T4/T4A report and see a Red line of text indicating that there are employees with CPP/EI mismatches, you will need to correct them prior to finalizing the T4’s. eNETEmployer provides this functionality by allowing you to edit your T4/T4A data.

NOTE: Click on the images below to view them at full size

To Review a CPP Mismatch:

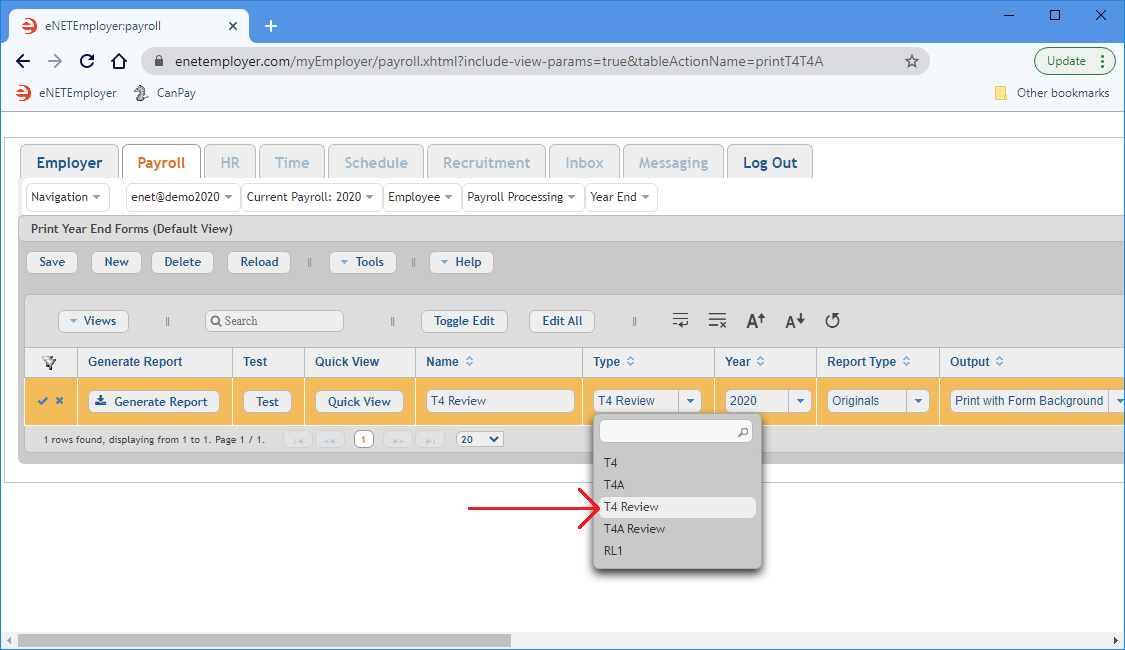

- From the Payroll tab, open the Year End - Print Year End Forms screen. This is where you you can work with all aspects of year end reporting including viewing, printing, and exporting.

- Ensure that the T4 Review option selected in the Type cell (see below). Note: if there are no report rows in the table, you must use the New button to add one.

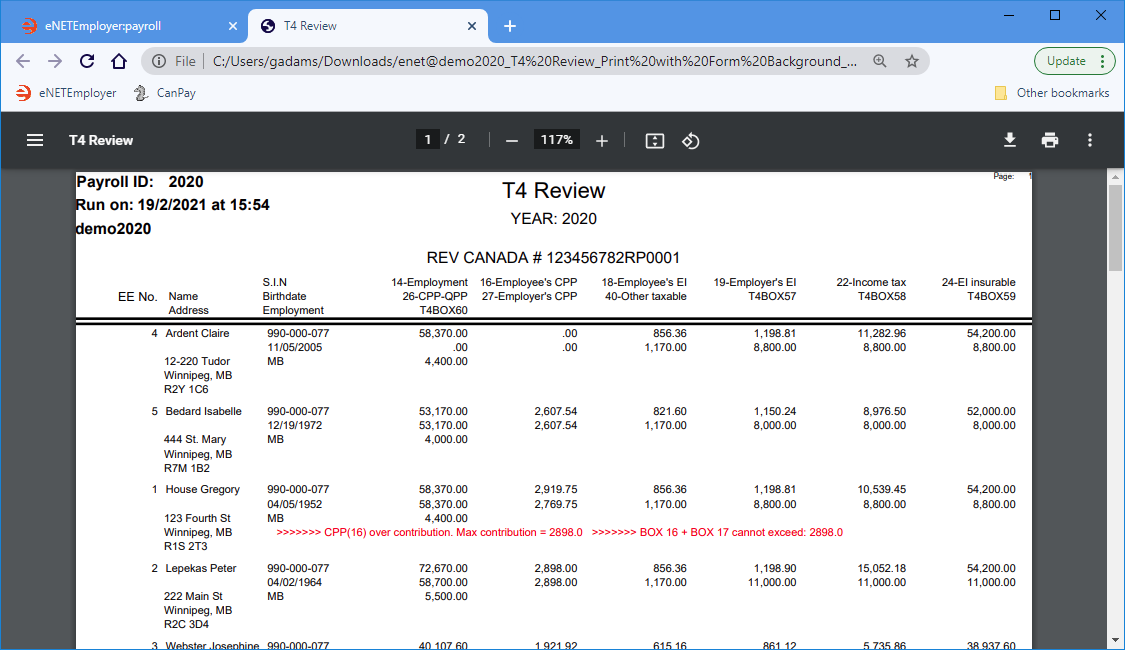

- Choose the Generate Report button to create the report. In the example below, the Red line of text indicates that the corresponding employee has a CPP mismatch.

- Unclose your payroll, make a year-to-date CPP adjustment to account for the mismatched amount, regenerate your T4s, and then create the T4 Review report once again to verify the adjustment. In some cases, the solution may be to simply amend the numbers as needed (e.g. adjusting an employee's tax to make up for a CPP shortfall). However, be aware that editing the assigned box values may not always be the best solution. The Edit T4/T4A feature is provided to help you correct legitimate errors made during the payroll cycle.

- Remit the difference to the CRA when you process your taxes for the year. If an employee has not been deducted the correct amount of CPP and comes up short for the year, many employers simply make up the difference (if it was the Payroll department's error). If the amount is significant, the employee should be notified of the shortfall and steps should be taken to make amends.

The CRA makes it your responsibility to ensure that this data is correct. If you submit a Year end file with mismatched values, the CRA will issue you a PIER report once they process your data (if the difference is greater than $1.00).

Now that you have found the employee with the mismatch, you have several choices:

See Also

- Year-End Overview

- Employee T4s

- Edit T4s help page

- Generate your employee T4s

- Review your employee T4s

- Edit your employee T4s

- Add a T4 manually

- Employee T4As

- Edit T4As help page

- Generate your employee T4As

- Review your employee T4As

- Edit your employee T4As

- Add a T4A manually

- T4/T4A Reports

- Magnetic Media Filing