Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Working with T4s

As part of the year-end procedure, eNETEmployer allows you to create T4s for your employees and for submission to the CRA. You may also find it necessary to change a box number assignment for an earning or deduction. eNETEmployer offers this functionality by allowing you to edit the values for each item as they relate to the T4 process.

There are four parts to this tutorial:

- Part A - Generate the T4s - Generating a T4 for each employee is mandatory to complete the year end process. This part of the tutorial will show you how to generate the T4s automatically.

- Part B - Review the T4 Data - This step will show you how to view each employee's T4 data.

- Part C - Edit the T4 Data - This third step is only necessary if you need to make changes to a box assignment.

- Part D - Manually add a T4 - This step is necessary when a given employee has not already had a T4 generated for them during the year end process, or if you need to add another T4 over and above their existing form.

NOTE: Click on the images below to view them at full size

Part A) To generate your employee T4s:

- From the Payroll tab, open the Year End - Edit T4s screen where you can view and edit each employee's T4 and RL-1 (the latter for Quebec employees only).

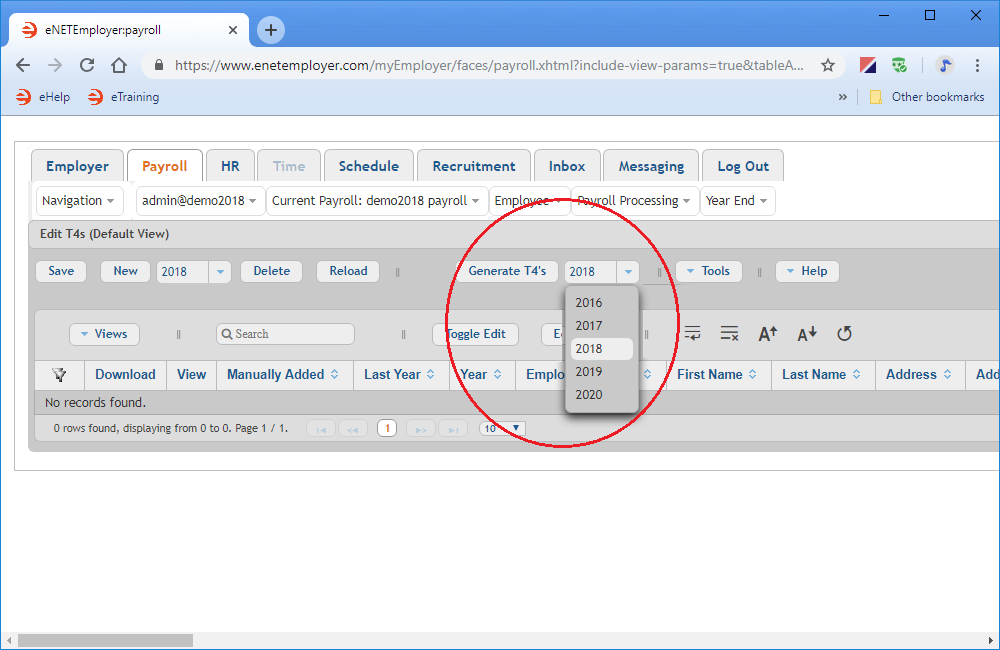

- Click on the drop-down list beside the Generate T4s button and then select the year for which the T4s will be generated.

Example: In Fig. 01 below, we will choose the year 2018.

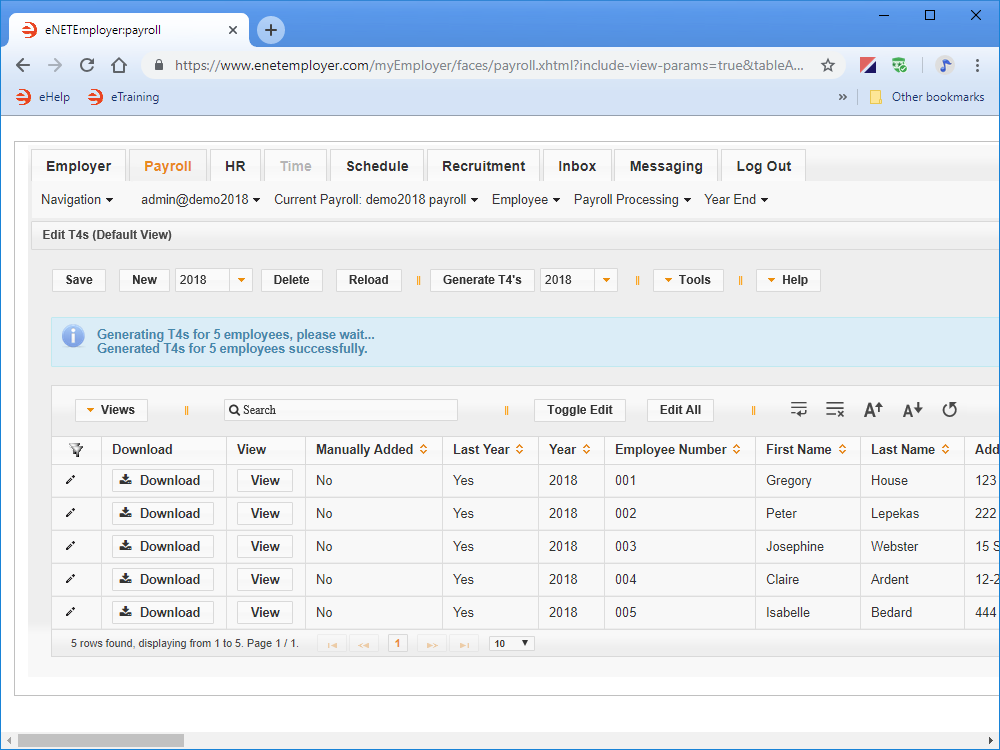

- Once you have chosen the year, select the Generate T4s button. This creates the T4s for each employee and a message will appear indicating the number of employees that were processed and the number of T4s that were successfully generated.

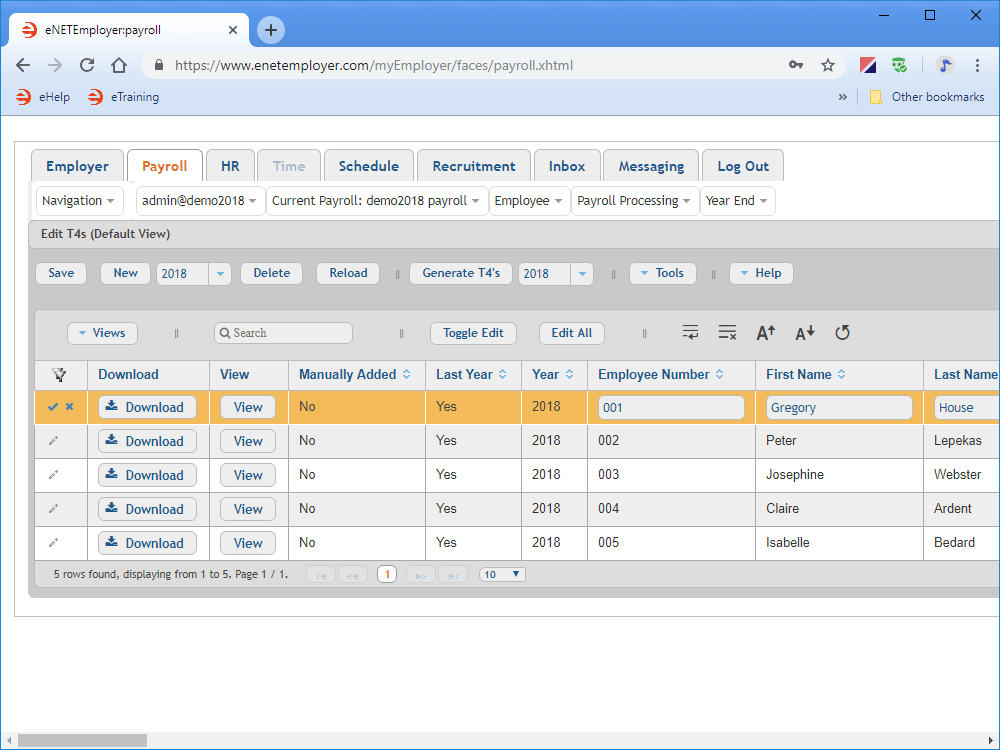

Example: In Fig. 02 below, we see that 5 employees now have their T4s ready for review.

This completes the section on generating your employee T4s. Now you can proceed to the next section that discusses how to review each employee's T4 data.

Part B) To review your employee T4s:

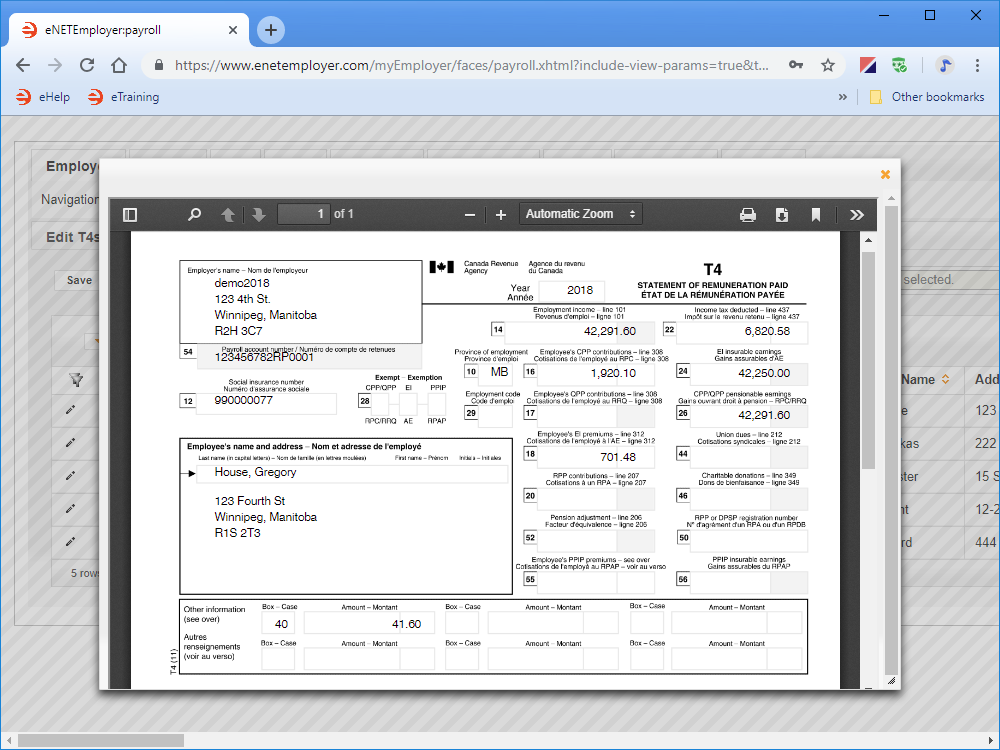

- In the Year End - Edit T4s screen, click on the View button for an employee whose T4 you wish to view. This displays the employee's T4 data in a pop-up window.

Example: In Fig. 03 below, we chose the first employee in the list; Gregory House.

- Use the Automatic Zoom option if you wish to make the details larger. You can also use the double arrow at the top right of the pop-up window to access a series of useful viewing tools.

- When you are finished reviewing the data, choose the Close button (the "X") from the top right of the window.

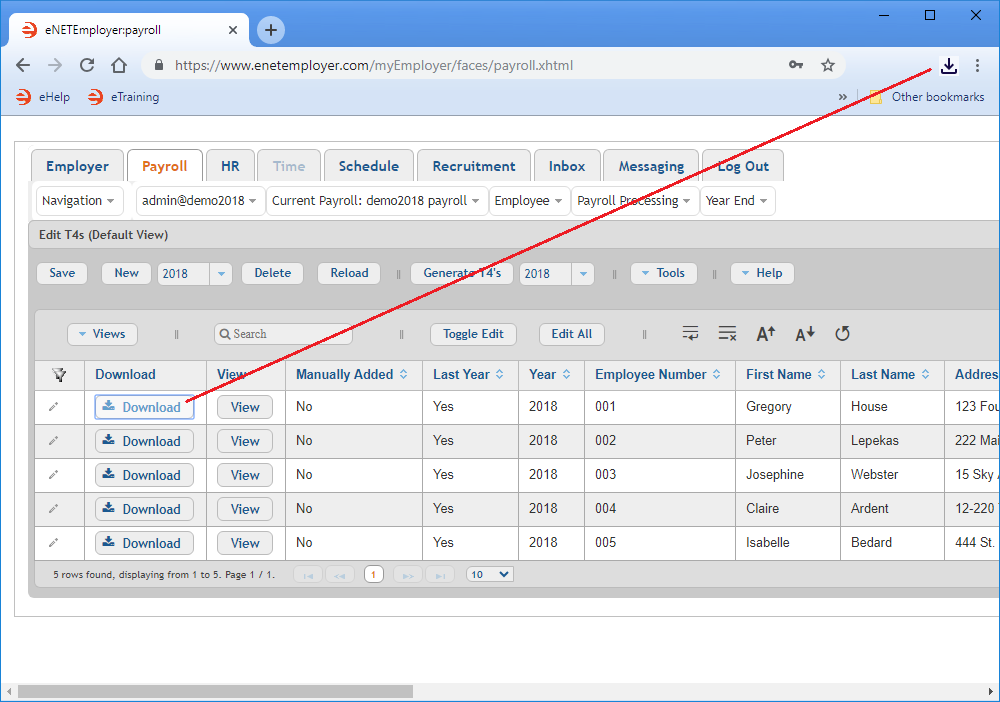

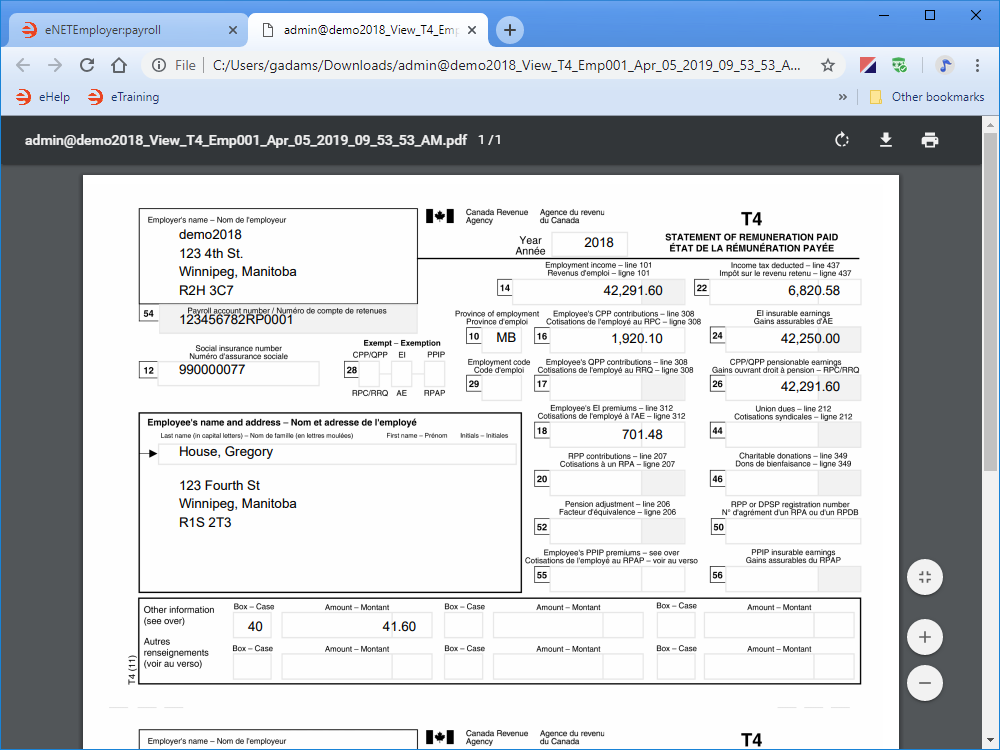

You can also review the T4 as a PDF file that can be downloaded, printed, or emailed to the employee.

- Choose the Download button to save the T4 report as a .PDF document. Depending on your browser settings, the resulting document will either be stored in your Downloads folder or you may be presented with a window that will prompt you where to save the file. In most browsers, the document can be viewed via a link that appears at the top-right of your browser.

- Click the Download link to access the file, or navigate to your Downloads folder and open the document using your preferred PDF viewer. When the T4 appears on the screen, you can scroll through the document and review the employee's data in detail.

Example: In Fig. 05 below, we can review the employee's T4 totals in detail. - When you have finished reviewing the employee's T4, close the report and return to eNETEmployer.

This completes the section on generating your employee T4s. Now you can proceed to the next section that discusses how to review each employee's T4 data.

Part C) To edit an employee's T4:

- Double-click on the row of an employee whose T4 you wish to edit. This changes the row to Edit Mode and activates the cells for editing. Note: You can select the Pencil icon located at the left side of the row to perform this same action.

Example: In Fig. 06 below, we chose the first employee in the list; Gregory House.

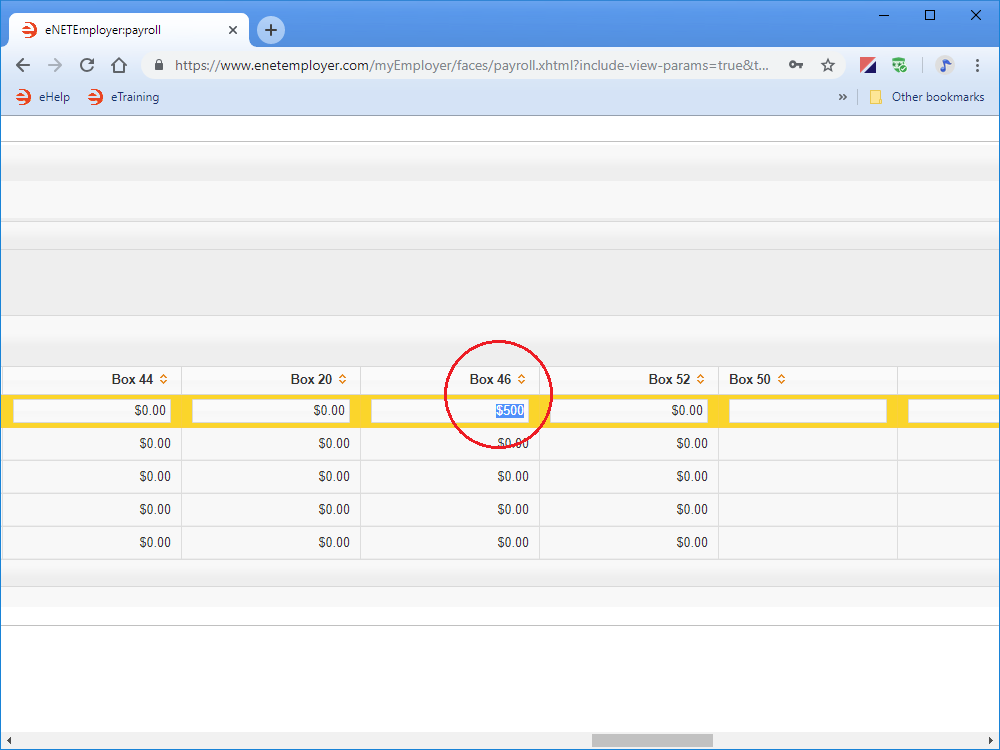

- Move to the desired cell or box number and make your changes as needed.

Example: In Fig. 07 below, we edited Box 46 to add a $500 amount for the employee's charitable donation.

- Repeat the preceding step for any other employee(s) whose T4 data required editing.

- Once your edits are complete, select the Save icon (the check mark icon at the left side of the row). This accepts the changes and the Edit Mode icons are removed to indicate that the row changes have been saved. You can also choose the Save button from the Button Bar above the table.

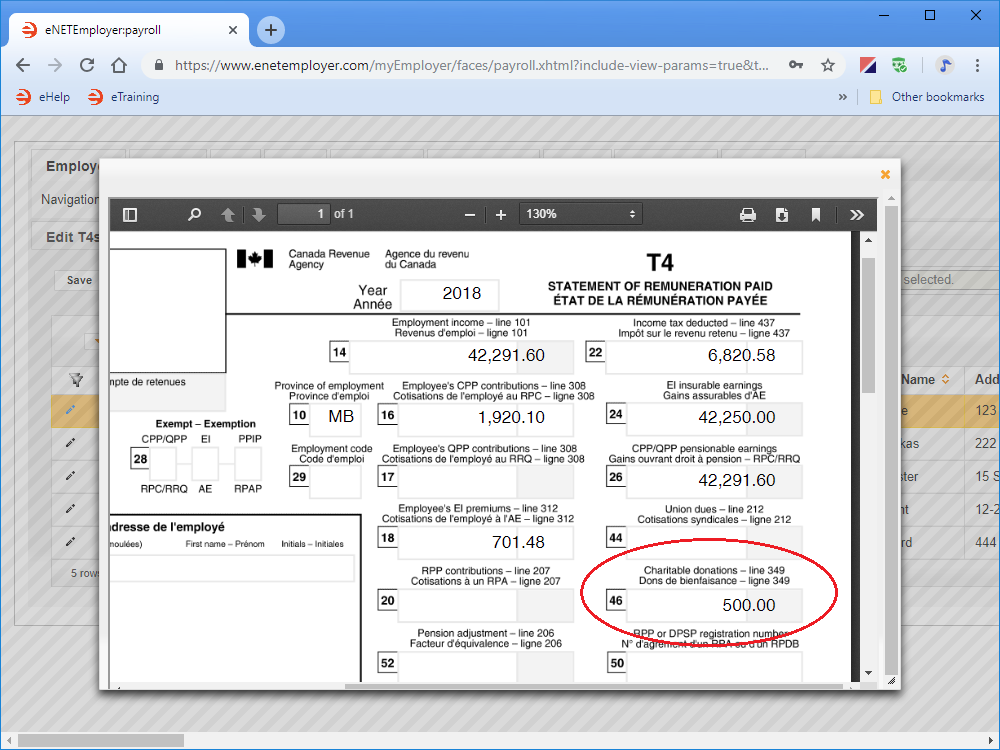

- To review the employee's revised T4, click on the View button for the employee. The revised T4 shows the changes that you made.

Example: In Fig. 08 below, Box 20 has been changed to reflect the additional $12,500 amount.

- When you are finished reviewing the data, choose the Close button (the "X") from the top right of the window.

Part D) To Manually Add a T4:

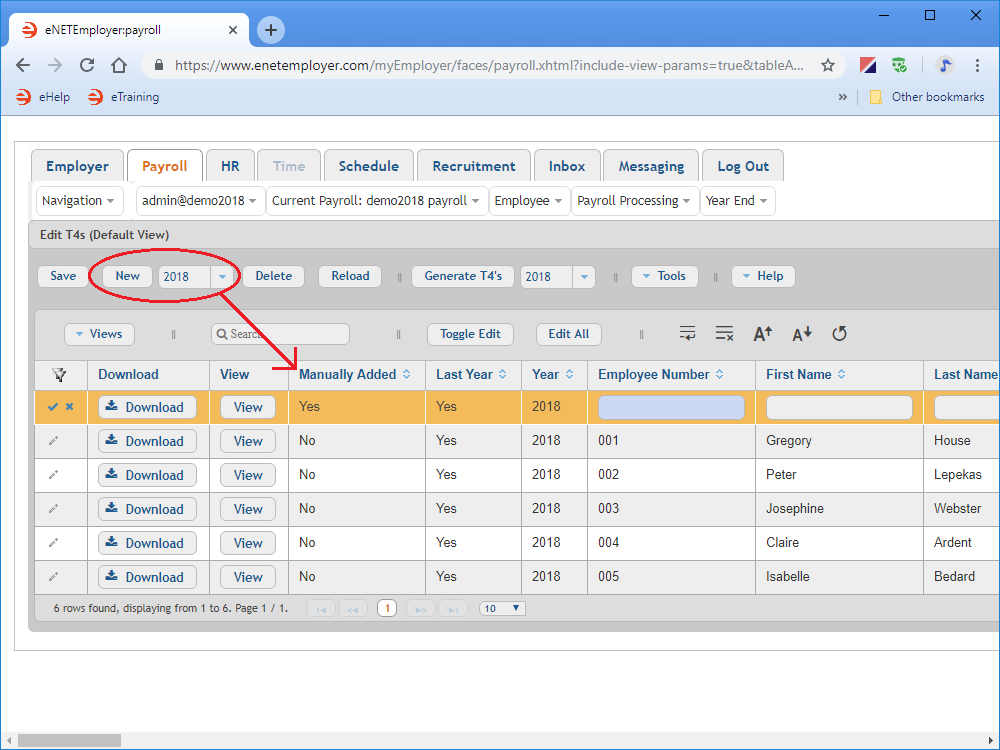

- Ensure that desired tax year is shown in the drop-down list beside the New button, and then select the New button. This adds a T4 row to the table and its cells appear ready for editing.

- Edit the cells as needed for your employee's T4 form, and then Save the changes when you are complete.

Example: In Fig. 09 below, we have manually added a T4 for one employee. Notice how the Manually Added column reads "Yes" to indicate that it was added manually.

This completes the tutorial on generating and editing your employee T4s.

Note: If you wish to continue with the year end process, please refer to the links below.

See Also

- Year-End Overview

- Employee T4s

- Edit T4s help page

- Generate your employee T4s

- Review your employee T4s

- Edit your employee T4s

- Add a T4 manually

- Employee T4As

- Edit T4As help page

- Generate your employee T4As

- Review your employee T4As

- Edit your employee T4As

- Add a T4A manually

- T4/T4A Reports

- Magnetic Media Filing