Help Toolbar (select a button to browse other online help sections) Home Tutorials Resources Search Tabs & Menus Button Bar Table & Data Display |

Submitting an XML File to the CRA

Like other software programs, eNETEmployer does not automatically submit or transfer your XML file to the CRA. The CRA provides the Internet file transfer (XML) application for this purpose. All you need is a Web browser to connect to the Internet, and the XML file that you generate from the eNETEmployer software program.

Before You Begin: - This tutorial assumes that you have created the XML data file as discussed in the Creating an XML Data File tutorial. |

NOTE: Click on an image below to view it at full size.

To Locate and Submit your XML File:

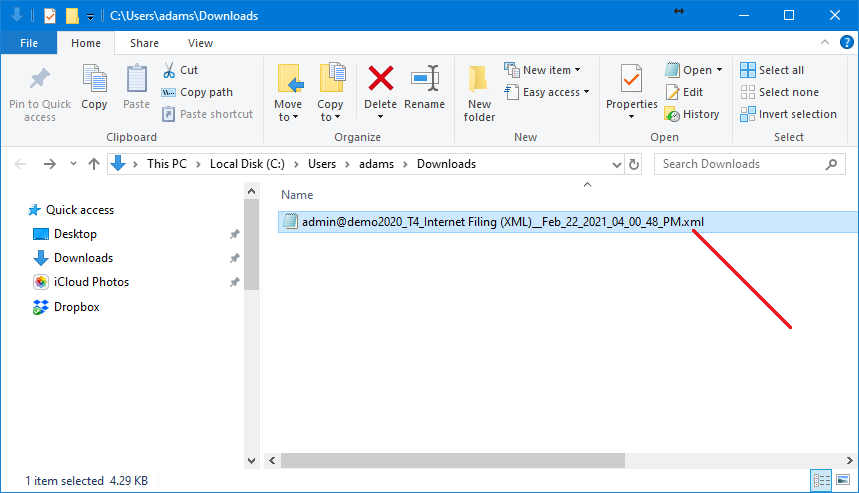

- Open the Downloads folder on the computer that was used to complete the payroll (this is the default location where XML files are saved). If you have saved the XML file in another location, then browse to that folder instead.

Cannot Find your XML File? - If you cannot locate your XML file, you can do any of the following: - Recreate the XML file using the instructions shown in the Creating an XML Data File tutorial, or

- Use the Windows Search feature to search for files on your computer that have an .XML extension.

Example: In Fig. 01 below, we have browsed to our Downloads folder where we can see our sample XML file.

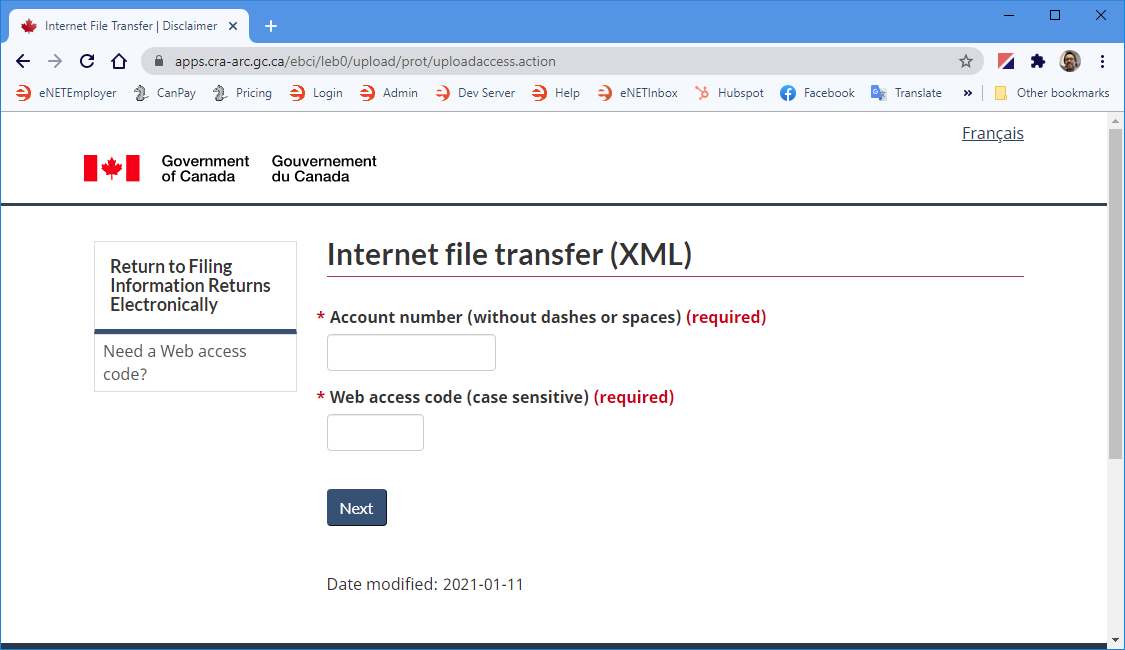

- Once you have located your file, browse to the CRA's Filing Information Returns Electronically web page. this page provides a list of useful information along with the instructions that you need to prepare for the file for uploading. Note: Before you visit the CRA's website, you should have two items on hand: 1) your company's CRA account number, 2) the Web access code (WAC) associated to this number.

- Use the Next button to move through each screen in the process.

- When you are prompted to upload the XML file, navigate to your XML file location and select the file that you created in eNETEmployer.

- Use the web page's upload feature/button to complete the file transfer process.

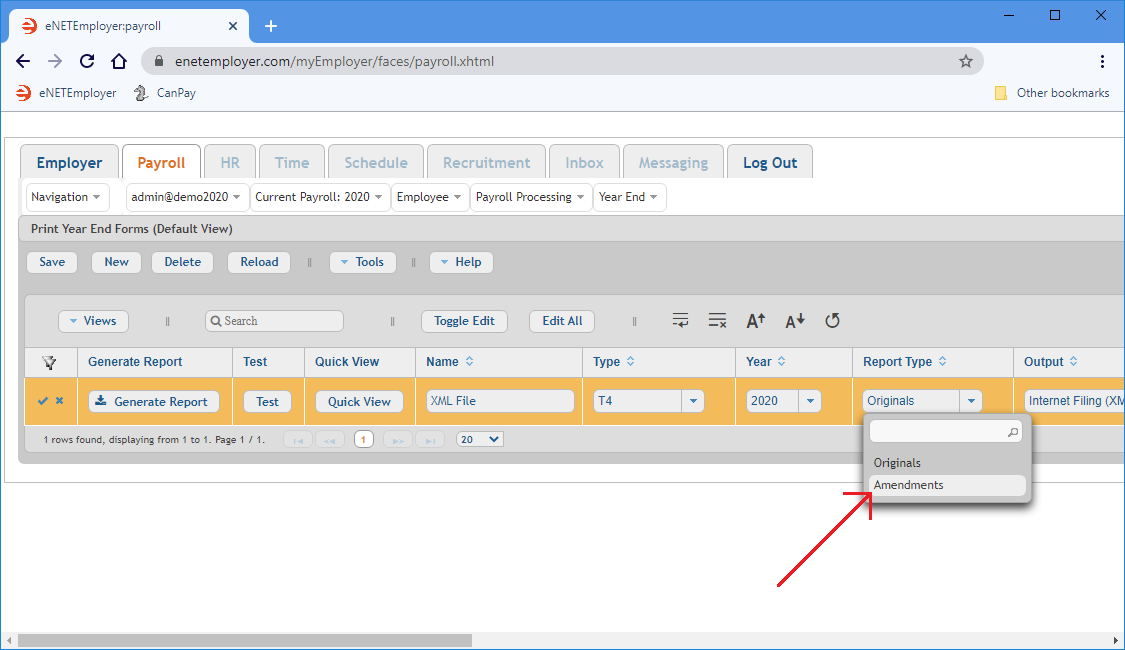

Amendments or Corrections: - The CRA permits you to make an amendment or correction after you have already submitted an XML file. To do so, open eNETEmployer and edit the T4(s) as needed (in the Year End - Edit T4s page), select the Amendments option from the Report Type cell (in the Year End - Print Year End Forms screen), and then regenerate the revised XML file and then resubmit it to the CRA.

This completes the tutorial on transmitting an XML file to the CRA for processing.

See Also

- Year-End Overview

- Employee T4s

- Edit T4s help page

- Generate your employee T4s

- Review your employee T4s

- Edit your employee T4s

- Add a T4 manually

- Employee T4As

- Edit T4As help page

- Generate your employee T4As

- Review your employee T4As

- Edit your employee T4As

- Add a T4A manually

- T4/T4A Reports

- Magnetic Media Filing